In the world of travel, meticulous budgeting ensures not only a prudent allocation of resources but also peace of mind. Imagine embarking on a dream trip without fretting about financial chaos. Utilizing a trip budget template empowers you to manage your finances efficiently. With AI tools, it becomes even more seamless to personalize your budget according to your needs. These advanced technologies bring accuracy and insight, helping you keep financial stress at bay and allowing you to enjoy every moment of your journey.

Introduction

A trip budget template is a meticulously structured tool designed to help travelers plan, track, and manage their expenses throughout a journey. By providing a clear visual framework of financial commitments, it helps avoid the uncertainties of overspending while enhancing clarity and control. Engaging with this tool ensures an organized and enjoyable experience, right from ticket purchases to dining at local eateries. In a world where travel budgets are often marred by unforeseen expenses, this template acts as a savior, keeping every transaction accounted for.

Why you need a trip budget template

Traveling can become an unexpectedly expensive venture if not properly managed, leading to potential overspending and financial anxiety. A trip budget template is a crucial tool for organizing and planning your expenses effectively. Here’s why it stands out as a beneficial companion for travelers:

- Clarity: It provides a precise financial roadmap, breaking down expected expenditures into categories such as flights, accommodations, and meals. Imagine booking a flight and having a breakdown that includes the cost of luggage and taxes as well as no more hidden surprises. A budget template ensures these expenditures do not slip through the cracks, making financial oversight more straightforward.

- Control: By setting clear financial boundaries, you have greater control over how funds are distributed across various expenses. Travelers can appreciate the reassurance of knowing their entire trip costs align with financial constraints, reducing the likelihood of incurring debt. This control elevates your travel experience as you have predetermined spending limits for different aspects of your trip, avoiding any impulsive splurging.

- Cost-saving: A budget template empowers you to make informed decisions by comparing potential spending against limits set. Identifying cost-effective alternatives, such as selecting an Airbnb over a hotel, could be the difference between sticking to a budget or overspending. By keeping travel plans within budget, you also secure extra funds for experiences that matter more, such as unique local excursions or dining.

In essence, a trip budget template offers an invaluable financial blueprint that promotes disciplined spending and enhances travel experiences, ensuring that memories, not monetary worries, last long after the journey ends.

How AI trip planners can help optimize your travel budget

AI-assisted travel planning is revolutionizing how travelers manage their budgets by analyzing numerous data points to propose the best financial strategies. These smart technologies bring a range of advantages that enhance financial decision-making on trips:

- Personalization: Unlike static templates, AI tools can dynamically tailor budgets by analyzing travelers’ preferences and constraints. By factoring in individual travel styles and financial limits, these planners can suggest itineraries that offer the best value.

- Efficiency and Speed: AI planners can process vast amounts of data at high speeds, ensuring you receive up-to-date price comparisons. For instance, they can analyze prices from various airlines to recommend the most affordable flight options, saving you hours of manual research.

- Financial Management: AI tools often come integrated with features that automatically track and categorize your expenses during the trip. This real-time expense-tracking ensures that travelers stay informed about their spending, identifying areas for cost-saving before overspending becomes a concern.

- Predictive Analysis: Advanced AI capabilities predict cost fluctuations in accommodation and transportation, allowing travelers to mitigate potential expenses effectively. imagine being alerted about a rising airfare, empowering you to book ahead and secure a lower price.

In summary, AI trip planners not only simplify the travel planning process but also enhance budget management by providing personalized, data-driven recommendations. These insights optimize financial resources, ensuring travel plans remain both affordable and memorable.

Ideal for solo, couple, group, and family travel

Whether you are a solo adventurer, traveling as a couple, part of a group, or planning a family vacation, a trip budget template can cater to diverse travel needs, ensuring financial agility and efficiency:

- Solo Travelers: Often looking for unique adventures on a budget, solo travelers can leverage budget templates to maximize their exploration without breaking the bank. They can effectively outline fixed expenses, such as hostels and transportation, while leaving room for spontaneous activities, such as unplanned city tours or local dining experiences.

- Couples: For romantic getaways, couples can utilize these templates to allocate funds for intimate dining experiences and scenic getaways, all while keeping tabs on shared costs. With a clear breakdown of expenses, partners can decide jointly on what experiences to indulge in, like vineyard tours or spa days, while respecting financial limits.

- Group Travel: Organizing collective travels demands meticulous tracking of shared costs. Trip budget templates simplify this by categorizing group expenses under areas like accommodation and shared activities. They promote transparency by keeping everyone in the loop and ensuring that individual contributions are clear and equitable.

- Families: Traveling with a family introduces additional budgeting considerations, such as kid-friendly activities and meals. Budget templates help manage these distinct needs by setting aside predetermined amounts for each participant, ensuring all family members enjoy a well-rounded vacation without financial strain.

Ultimately, a trip budget template ensures that no matter the composition of the travel party, finances are wisely managed to accommodate different travel arrangements and preferences, enhancing the overall joy and success of the trip.

What is a trip budget template?

At the heart of effective travel planning lies a trip budget template a detailed tool that assists travelers in forecasting, tracking, and analyzing their travel expenses with precision. It organizes potential costs into manageable categories, promoting clarity and financial discipline throughout the journey. This tool is invaluable for preventing financial mismanagement and enhancing the quality of travel experiences.

Definition and purpose

A trip budget template is a structured format designed to help travelers precisely estimate and manage their travel expenses. It encompasses all potential spending categories, enabling travelers to align their financial plans with realistic cost expectations. Here’s how it plays out in practice:

- Defining expense categories: The template systematically lays out expense categories such as transportation, accommodation, dining, and leisure activities. By segregating these costs, travelers can quickly ascertain where funds are being allocated and identify areas for adjustment or cost-saving.

- Purposeful budgeting: The main objective of using a trip budget template is to create a roadmap of anticipated expenses, setting realistic financial limits that reduce the risk of overspending. For instance, non-essential expenses like souvenirs and luxury activities can be periodically assessed for trimming to accommodate priority spendings.

- Encouraging savings discipline: By facilitating a clear overview of intended expenditures versus actual spending, the template serves as a motivational tool for setting and achieving savings goals pre-trip. For example, identifying a potential savings target for a dream destination may compel a traveler to cut back on discretionary purchases leading up to the trip’s date.

A trip budget template thus acts as a meticulous financial planning tool that consolidates travel expenditures, promotes disciplined financial management, and ultimately enhances the travel experience by allowing for a clear and organized approach to spending.

Format options: Google Sheets, Excel, Notion, PDF, or mobile app

The flexibility of format options for a trip budget template allows users to select the tool that best suits their preferences and technological comfort. Here’s a comprehensive look at some popular choices:

- Google Sheets: This cloud-based tool offers the convenience of real-time collaboration and access from any device. Google Sheets is ideal for travelers desiring a collaborative approach to budget management, enabling real-time updates and sharing with travel companions.

- Excel: Microsoft Excel remains a popular choice due to its advanced functionalities and robust analytical tools. This format suits travelers who prefer traditional, feature-rich spreadsheet applications that allow extensive customization, complex formulas, and detailed data visualization.

- Notion: Known for its adaptability and aesthetic presentation, Notion combines spreadsheets with rich text editing. This format is suitable for travelers looking to integrate budget tracking with travel journaling or other planning activities in a single, cohesive space.

- PDF: For those seeking a static and easily shareable format, PDFs provide a portable document structure that allows for easy printing and distribution, making it ideal for sharing plans with less tech-savvy travelers.

- Mobile Apps: Portable apps offer a user-friendly, on-the-go option for managing travel budgets. Ideal for travelers who need quick access to financial data and expense tracking during their trip, apps like Trail Wallet and TravelSpend feature intuitive interfaces with real-time alerts and insights.

Each of these format options provides unique functionalities, ensuring that the user’s preferences and travel companion needs are accommodated seamlessly.

Key components of a trip budget template

A trip budget template isn’t merely a static checklist of expenses; it’s a dynamic tool that integrates various components critical to any travel itinerary. These components encompass transportation, lodging, meals, activities, and more, providing a thorough overview of expected expenditures.

Transportation (flights, local transit, taxis)

Transportation forms a significant portion of any travel budget, covering myriad costs from flights to local commuting. A comprehensive template must itemize these expenses to keep travelers financially prepared.

- Flights: Considering the fluctuating nature of airline pricing, budgeting for flights involves capturing multiple costs such as base fare, taxes, baggage fees, and any additional charges related to seat selection or onboard services. Comparing prices from various airlines and booking well in advance can uncover potential savings, aligning flight costs with budget targets.

- Local Transit: Expenses don’t stop with flights; local transport must be equally planned for. Options such as buses, subways, and regional trains fall under this, and budgeting may involve purchasing metro cards or day passes that offer unlimited travel within a certain duration at a discounted price. Understanding local transit fare structures ensures accurate financial forecasting.

- Taxis and Ride-Sharing Services: Allocating funds for taxis or ride-sharing services like Uber or Lyft can help cover unavoidable gaps where public transportation may be unavailable or impractical. Calculating costs for common routes, like airport transfers or travel between accommodation and attractions, equips travelers with realistic expectations and better financial control.

Breaking down transportation costs into these distinct categories ensures that you’re accounting for every aspect of travel, allowing for an organized approach to navigating a new environment financially.

Accommodation (hotels, hostels, Airbnb)

Accommodations can greatly influence the overall cost of a trip, making this component vital in any travel budget template. Here’s how to navigate it:

- Hotels: These often serve as the most traditional lodging option, with prices varying based on location, star rating, and amenities. To optimize hotel costs, you may consider booking in advance or leveraging loyalty programs. Keep an eye on deals or booking platforms that offer price guarantees.

- Hostels: Particularly appealing to budget-conscious travelers or backpackers, hostels offer shared dormitories alongside private room options. Their charm often lies in fostering community interactions, making them an economical choice for those embracing a social atmosphere during travels.

- Airbnb or Vacation Rentals: Often providing localized stays with homely comforts, Airbnb caters well to those wishing for unique lodging experiences. Evaluating criteria such as location, duration, and additional service fees remains essential for accurate budgeting, ensuring these costs align with the financial framework.

By recognizing varying accommodation options and strategically planning for these, travelers can secure the most cost-effective, enjoyable lodging per their budgetary constraints.

Food & Dining (meals, snacks, drinks)

Food and dining present significant yet enjoyable components of any travel budget. Exploring local culinary flavors enriches travel experiences, albeit necessitating careful budget planning:

- Meals: Dining expenses can quickly add up, so distinguishing between fine dining and quick eats is critical. Researching local eateries, food markets, and street vendors can offer authentic experiences at lower costs, allowing funds to stretch further.

- Snacks: Factoring in snacks between meals helps allocate funds accurately. Stocking up on supermarket items or local treats provides nutritional variety without the need to splurge at cafes.

- Drinks: Including expenditures on both non-alcoholic and alcoholic beverages ensures comprehensive budgeting. Whether sipping a local brew at a bar or grabbing a coffee at a café, pricing can vary widely based on location, impacting daily travel budgets.

Crafting a balanced food budget aligns with necessary dietary requirements while respecting the broader travel financial plan, leaving room for special culinary splurges when desired.

Activities & Tickets (tours, museums, shows)

Activities encompass both planned excursions and spontaneous moments that color travel experiences, warranting careful consideration within the budget template:

- Tours and Excursions: Pre-booking tours or excursions often secures the best rates, with opportunities to find discounts through travel bookings or city passes. Allocating funds for these experiences ensures access to enriching cultural or historical insights without unexpected cost burdens.

- Museum and Attraction Fees: Many cultural destinations charge entrance fees that vary greatly budgeting for these visits necessitates research and potentially prioritizing interests to manage costs.

- Shows or Events: Attending concerts or local performances can provide memorable entertainment. However, ticket prices may vary widely, so setting aside a dedicated budget helps prevent overscheduling or financial strain.

By thoughtfully including activity-related costs in the budget template, travelers ensure they can relish immersive experiences while maintaining financial structure.

Travel Insurance and Visa Fees

Travel insurance provides essential coverage for unforeseen events, making it a non-negotiable component of travel planning. Here’s why it is crucial:

- Medical Emergencies: Medical costs in foreign countries can be prohibitive without insurance. Opting for travel insurance that covers emergency medical care is a prudent step that offers peace of mind.

- Trip Cancellations: Situations beyond control can result in canceled travel plans. Insurance that reimburses non-refundable expenses ensures travelers do not suffer financial losses due to unforeseen events.

- Visa Fees: Accounting for visa application costs well in advance eradicates the risk of underestimating travel expenses. It’s crucial to understand the entry requirements for a destination as visa costs can vary significantly.

By incorporating insurance and visa fees into the budget, travelers safeguard against unexpected disruptions, ensuring preparedness and continuity of their travel plans.

Shopping & Souvenirs

Shopping may not be the primary focus of travel, but it forms a charming element of the travel experience. Here’s how to navigate it within a budget:

Within a trip budget template, visitor-centric expenses must be isolated and calculated clearly.

- Budget Plans: Creating a defined budget for shopping, segmented into essential purchases and planned souvenir acquisitions. Deciding on desired items in advance helps manage funds and avoids impulsivity.

- Local Prices: Researching market prices for goods in advance, including cultural items, clothing, or art. Making a list prevents emotional purchases, allowing travelers to prioritize meaningful selections.

- Buffer Expenses: Cushioning with an allowance for spontaneous purchases or necessary items ensures flexibility, empowering financial security during varied shopping environments.

Crafting a detailed shopping and souvenir budget lets travelers navigate markets as budget-savvy shoppers, ensuring balanced travel remains an attainable endeavor.

Emergency or Buffer Funds

Creating a trip budget also entails preparing for unforeseen circumstances to absorb unexpected financial burdens without stress.

By including a buffer fund within a trip budget template, the emphasis on financial resilience becomes apparent, protecting against financial shocks such as emergency medical care or unplanned itinerary changes.

- Emergency Fund: A buffer set at approximately 10-20% of the total trip budget preempts potential emergencies, covering spontaneous expenses that may arise.

- Flexibility: Offering adaptability for immediate use when necessary, ensuring continuity and security for travelers while repurposing funds for any unplanned expenses beyond the initial budget.

- Peace of Mind: Explicitly constructing the fund encourages accountable financial behavior and mitigates stress over emerging travel disturbances.

Buffer funds reassure travelers with a financial antidote against uncertainties and unanticipated scenarios, allowing focus on the journey rather than budgetary disruptions.

Explore the latest posts in our AI Travel Guide to craft the best travel plans tailored for you.

How to build your own budget template

With detailed insights into key components of a trip budget template, travelers can initiate their personalized versions by following a systematic approach. The foundation of an efficient budget is a cohesive structure coupled with clear objectives, ensuring comprehensive expense coverage for an enriched travel experience.

Step-by-step structure for manual setup

Building a personal budget template involves crafting an organized structure suitable for travel management.

- Getting Started: Launch a new workbook in tools like Excel or Google Sheets. Ensure columns are wide enough for comprehensive data entry, enabling easy understanding.

- Categorize and List: At the top, title sections for each major travel component: Income, Expenses including further subdivisions for transport, accommodation, dining, and more.

- Tracking Income: Document any relevant income sources, ranging from savings, salary, or travel pledges, clearly listed for quick reference. Aggregate the total.

- Expense Breakdown: Focus on listing anticipated expenses under their respective categories, outlining each item’s anticipated cost meticulously. Invoking subtotal categories ensures clarity.

- Remaining Balance: Calculate overall spending against income to highlight remaining savings or surplus, suggesting necessary budgetary adjustments or encouraging prudent spending.

By following these steps with dedicated attention, you establish a robust framework to guide financial decisions and maintain fiscal responsibility.

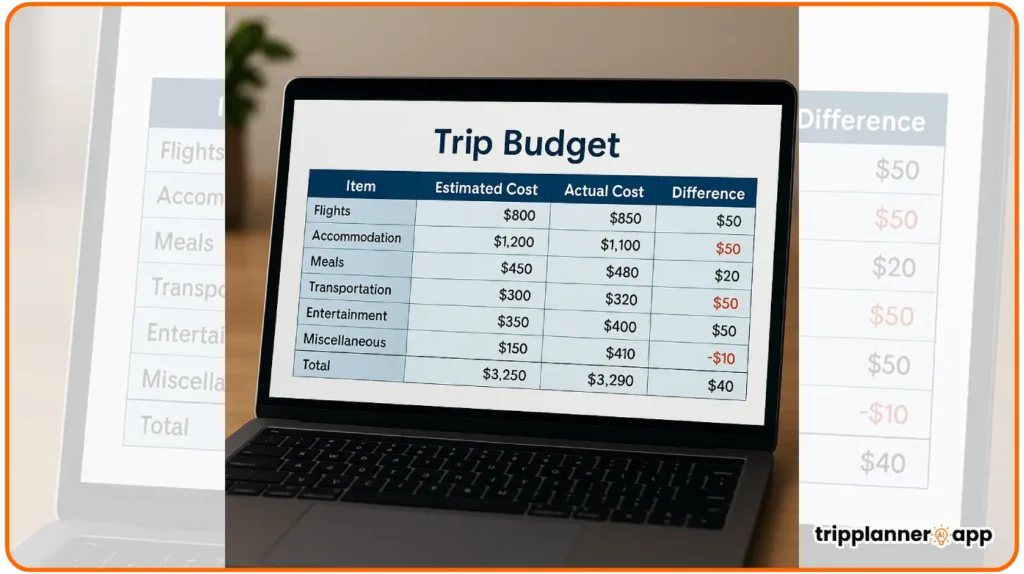

Sample column layout (category, budgeted, actual, notes)

The fundamental layout of a column-driven budget template involves establishing key headings to guide expense tracking.

- Category: Detailing the relevant areas of expenditure, creating a list from planned trip costs like flights and lodging to spontaneous categories, e.g., dining locally or exploring native activities.

- Budgeted Amount: Establish options for anticipated financial outlay, indicating foresight while highlighting financial estimates for optimal planning.

- Actual Spending: Continuous tracking reflecting real expenses that ensure budget adherence. Enter specifics for accurate budgetary analysis.

- Notes Section: Captures context around discrepancies, such as unexpected costs or travel savings for future reference and adaptability.

By engaging currency-neutral notes, monitoring budget adherence as variations emerge becomes more manageable, improving future budget accuracy.

Tips on creating dynamic templates with formulas

Enhancing your budget template with dynamic elements breathes flexibility and convenience into financial planning.

- Using Formulas: Integrating functions like =SUM or =AVERAGE calculates totals efficiently, ensuring that the template reacts dynamically to changes in costs, affording accurate computations with time configuration.

- Conditional Formatting: Color-coding cells helps intuitively signal when spending exceeds budgeted amounts, offering immediate attention to potential spending issues.

- Automated Recalculations: Employ features to recalculate running totals when adjustments are made, ensuring that budgeting remains current and integrated. Simultaneously, defining range formulas simplifies comprehensive data collation.

- Adaptability: Establish an organized process for repetitive tasks while remaining agile in addressing larger-scale modifications, custom-tailored to individual initiatives.

These dynamic formatting cues revolutionize templates, uncovering the potential for seamless and responsive budget monitoring, preparing travelers for well-calculated financial navigation.

Visual charts or pie graphs for better insight

Incorporating graphical data representations into travel budget templates delivers immediate visual insight into spending distribution.

- Pie Charts: Clean and colorful, these charts transpire vivid snapshots of proportional spending, aiding quick identification of fiscal vulnerabilities or oversights. They also serve auditor candidates by specifying distinct components within the overarching budget.

- Bar Graphs: For detailed comparison, bar graphs convey category-specific spending surpluses or deficiencies against broader trip expectations, generating projective insight into segmented iterations such as proximity pairing fares versus hospitality divergences.

- Engage Side-by-Side: Familiarize by comparing budget adherence against overall fiscal performance, stimulating intuitive travel management dynamic while engendering ongoing context between continuous and instantaneous updates.

- Presentation Clarity: Proactively formatting using enhanced visuals not only facilitates financial insight but assists in outlining necessary modifications discernibly, minimizing potential mistakes and enhancing personal finance strategy.

Visual tools reinforce budget alignment in a symbiotic partnership, equally informative to solo assessment and peer collaboration, ultimately optimizing travel plans through vibrant, visually compelling insights.

Best practices for travel budgeting

Building your personalized budget template sets the groundwork for enhanced travel planning. Implementing best practices for ongoing budgeting promotes dynamic financial management and enriched travel experiences, ensuring every journey remains financially resilient, strategic, and fulfilling.

Always add a contingency buffer (~10–15%)

Planning for uncertainty is a hallmark of successful trip budgeting, emphasizing forward-thinking resource management by integrating a contingency buffer.

- Preparing for the Unforeseeable: Unplanned circumstances such as emergency healthcare or itinerary disruptions require absorbing financial impact. Creating a designated, pre-calculated buffer fund expresses monetary adaptability, preparing beyond initial basic guidelines.

- Guaranteed Peace of Mind: Offering conscious peace of mind, travelers core capacity remains undisturbed through enriched fiscal foresight, supporting unexpected accommodations or alternative scheduling at ease.

- Staged Planning: Segment the built-in buffer alongside standard budget categories, enhancing resolve against variance, promoting optimal usage around singular standout transactions, whether additional service amenities or value-based experiences.

Contingency buffer implementation serves as the benchmark for financial flexibility, seamlessly weaving adaptability into every comprehensive budget layout.

Update actual expenses daily during trip

Maintaining real-time financial transparency is beneficial for all travelers, so diligently updating expenses daily becomes paramount.

- Integrity Fostering: Establish immediate monetary accountability by logging each transaction into budget templates. By sustaining day-wise tracking, travelers minimize oversight and immediate discrepancies emerge rather than festering cumulatively.

- Ongoing Evaluation: Evaluation upon evaluation allows factual alignment with proposed pre-planning, verifying causal correlations against actual performance. Daily record entries encourage daily reconciliations, accentuating wise spending decisions.

- Adjust and Refine: Modifications or course corrections heightened by formidable data-collection yield strategic flexibility, ultimately achieving higher precision against budget expectations, overriding pending constraints aesthetically.

Consider daily expense updates essential travel accommodations, raising budget benchmarks, ensuring high accountability levels with succinct records.

Compare planned vs. actual spending post-trip

Comparison between planned versus actual expenses post-trip offers valuable insights to inform future travel budgeting strategy.

- Post-Mortem Analysis: Critical evaluation against established structure distinguishes projected expectations against reality, identifying pertinent spending discrepancies across transportation, dining, or peripheral expenses.

- Performance Metrics: Analyzing financial performance, elucidating tangible deviations, and uncovering void areas offer travelers necessary strategic criteria associated with budgeting, ensuring successive optimization.

- Consider Historical Data: Collecting past budget files deepens judgment, compares financial patterns, and discovers trends synchronized across recurring travel itineraries for improvement.

Perspective pivot eclipses thematic excursions that extend the longevity of takeaways encompassing personalized knowledge application for sustained financial health.

Share and collaborate with travel partners

The inclusion of travel partners during budgeting defines collective success through informative initiatives and strategic decision-making collaboration.

- Interact and Inspire: Openly sharing budget dynamics with companions accentuates inclusivity encouraging informed dialogue, leveraging opportunity while promoting shared accountability among group travelers.

- Engender Feedback-qualified Refinement: Nurturing travel insight fostering between partners collaboratively enhances support networking across innovative channels, exchanging insights without efficacy risk facilitating measure-centered action.

- Optimal Cohesion: Transparent communication underscores cohesive community-strengthened travel budgets, engaging joint optimizations towards purposeful prioritization benefiting shared savings toward enriching outreach opportunities.

Synchronization channels collaborative capability, integrating collective budgeting commitment transformed into indispensable pragmatic decision-making tourists.

Final thoughts

A meticulous approach to travel budgeting propels you into financial empowerment, enhancing both experience and independence. The application of thoughtfully curated templates establishes steadfast control over expenditures, dissipating financial anxieties as an ally in your journey.

Indulging in strategic financial foresight imparts heightened control over travel finances knowing there is security poised for the unpredictable eventualities. A planned buffer for emergency funds empowers adaptable readiness, while scheduled updates subsequently adjust spending based on analytical post-evaluation.

Understanding best practices and dynamic template enhancement conveys precision, while integrated visual graphing ensures smooth expenditure navigation. Aligning personal expectation with actual budgeting experience creates unparalleled budgetary clarity, facilitating prevails globally, adapting still-constant principles for stabilizing plans.

At its very essence, trip budgets equipped with AI tools redefine exploration beyond scope; they transform travel into the canvas within which enduring shared experiences unfold. Meticulously crafted and prudently employed budgets permit memorable connections stirred by inspired intentions, weaving together stories of fiscal fulfillment and unforgettable journeys.