Imagine embarking on an unforgettable journey without the constant worry of draining your bank account. Trip budgeting offers the thrill of spontaneous adventures and authentic experiences while keeping your finances on track. This guide unravels savvy strategies and essential tools to master the art of budgeting, ensuring your travels are financially secure and remarkably stress-free. Continue reading to discover how to align your financial plans with your travel dreams, making every moment as memorable as the destinations themselves.

Introduction

Trip budgeting is your passport to a seamless travel experience. By intentionally planning your finances, you not only protect yourself from unexpected expenses but also enhance your ability to enjoy every aspect of the journey. This guide will walk you through a structured approach to budgeting, ensuring your financial health is compatible with your wanderlust. Let’s delve into the practical steps and tools that can shape your travel adventures without compromising your budget.

Why trip budgeting matters more than you think

Trip budgeting is often underestimated, yet its significance stretches far beyond mere financial planning. Effective budgeting allows travelers to allocate resources wisely, ensuring not just affordability but an enriched travel experience.

- Prevents Overspending: Without a robust budget, the risk of financial mismanagement is high. Overspending can ruin not just the trip but also your financial future. Through budgeting, you create a roadmap for your expenditures, ensuring every dollar is spent with purpose.

- Enhances Experiences: When you budget, you can focus more on experiences rather than juggling costs. Planning ahead allows allocation for unique experiences like a Michelin-star meal or an adrenaline-pumping adventure.

- Reduces Stress and Anxiety: With a travel budget in place, there’s less worry about financial constraints. You can immerse fully in the moment knowing your finances are in check.

A tailored budget supports your travel style, aligning your expenditures with what truly matters on your journey. Whether it’s food, activities, or accommodations, budgeting addresses your priorities, ensuring a harmonious travel experience.

Benefits of planning ahead financial and emotional

Planning a trip in advance yields both financial and emotional benefits. Financially, it opens doors to better deals, helping travelers secure discounted flights, accommodations, and tours.

- Economic Advantages:

- Early Bird Discounts: Many airlines and hotels offer reduced prices for early bookings.

- Fare Stability: The earlier you book, the less likely you are to face last-minute price hikes.

- Promotional Offers: Planning ahead lets you take advantage of special promotions that might not be available closer to your departure date.

- Emotional Satisfaction:

- Builds Anticipation: The excitement of a planned trip can boost your mood months in advance.

- Enhances Well-being: Anticipating an upcoming adventure provides a mental lift, relieving stress and promoting positivity.

- Preparedness: Being prepared with plans mitigates uncertainties, allowing travelers to focus on enjoyment.

Overall, planning ahead not only preserves your budget but also enriches your travel experiences, emotionally preparing you for the rewarding journey ahead.

Step 1: Decide your trip style and priorities

Knowing your trip style is critical for crafting a budget that truly reflects your travel aspirations. Based on your preferences, you might identify as a backpacker, mid-range explorer, or luxury traveler. Assigning priorities such as comfort, food, or activities helps in allocating resources where they count most, ensuring your trip resonates with what you value.

Are you a backpacker, mid-range explorer, or luxury traveler?

Understanding your travel persona guides where and how you allocate your budget, often shaped by priorities like comfort, experiences, and spontaneity.

- Backpackers: Primarily focused on budget-friendly traveling, they prioritize experiences over material comforts. They often choose hostels, dine on street food, and embrace spontaneity in their itineraries.

- Mid-Range Explorers: These travelers seek a balance of affordability and comfort. They favor boutique lodgings and a mixture of dining experiences, allowing flexibility but within calculated financial limits.

- Luxury Travelers: Willing to splurge on comfort, luxury travelers prioritize high-end accommodations and dining, often engaging in exclusive activities ensuring indulgent experiences.

Each travel style comes with different budgeting needs, dictates your accommodation choices, meal preferences, and types of activities you engage in.

Identify what matters most: food, comfort, activities, or flexibility

Deciding what you value most allows for efficient budget allocation, ensuring your travel experiences are not just cost-effective but personally enriching.

- Food: Prioritizing cuisine can dramatically impact your budget. Dining at local eateries versus upscale restaurants can save costs while delivering authentic culinary experiences.

- Comfort: If physical comfort reigns supreme, shifting funds towards premium accommodations can ensure a restful stay.

- Activities: Adventure enthusiasts should allocate a larger portion of their budget for tours and experiences.

- Flexibility: Desired flexibility can mean reserving funds for spontaneous plans, enhancing the trip’s unpredictability.

By understanding these priorities, your budget becomes a reflection of your values, maximizing satisfaction and minimizing financial strain.

Use AI (like ChatGPT) to clarify your travel goals

Leveraging AI tools can simplify decision-making, offering personalized travel insights tailored to your preferences and goals.

- Goal Refinement: AI can suggest destinations based on your stated interests, aligning travel goals with desired experiences.

- Budget Management: AI services can simulate budget scenarios, helping you understand how adjustments impact overall spending.

- Priority Advice: Whether you’re interested in eco-tourism or luxury, AI can analyze data to suggest the best avenues to pursue within your financial parameters.

Integrating AI ensures your travel plan is not only well-informed but also flexible enough to accommodate changing preferences or unexpected opportunities.

Step 2: Estimate core costs

Building upon your trip style and priorities, estimating core costs such as flights, accommodations, meals, and activities forms a potent foundation for your budget. These foundational elements transform travel aspirations into a financially viable plan, offering insight into potential expenditures while setting the stage for optimized spending.

Flights or transportation

Flights and transportation represent some of the most significant travel expenses, making strategic planning crucial.

- Compare Flight Costs: Utilize platforms like Skyscanner or Google Flights to juxtapose fare options, optimizing for budget and convenience.

- Book Early: Early booking generally secures better prices and wide availability.

- Low-Cost Alternatives: Evaluate budget airlines that offer affordable travel, especially for shorter routes.

By studying fare patterns or considering alternative transport means such as trains or buses, travelers can secure considerable savings.

Accommodation (hotels, hostels, Airbnb, homestays)

Accommodations can constitute a significant portion of your travel expenses, but choices abound to suit different styles and budgets.

- Hotels: Provide consistent quality and amenities but often come with higher price tags. Consider chain hotels if you’re part of a loyalty program to capitalize on member discounts.

- Hostels: Ideal for budget-conscious travelers, offering communal settings and kitchen facilities to offset meal costs.

- Airbnb & Homestays: These options assure affordability, especially for groups, and often deliver immersive, local experiences.

Authorities in online booking, like Booking.com or Airbnb, simplify the process of finding a stay in harmony with your financial considerations without curtailing comfort.

Food & daily meals (street food vs dining out)

Dining decisions can impact your budget and enhance your cultural exploration.

- Street Food: Provides an economical approach, allowing exploration of local flavors affordably. Street meals can range from $0.1 to $3.

- Dining Out: A meal at a casual restaurant could set you back $10-$30. Consider alternating between dining out and preparing meals yourself to control costs.

Balancing street food delights with occasional restaurant visits allows fleeting tastes of gastronomic mastery without overspending.

Activities and entrance fees

These costs greatly vary but can substantially shape your travel experience’s quality.

- Research Fees: Many attractions offer insights into admission or guide rates, revealing savings opportunities through early or bundled bookings.

- Free Days or Deals: Plan visits to museums or parks on free entry days or utilizing city passes.

- Unique Experiences: Prioritize funding for special excursions like guided tours for a personalized touch.

By efficiently researching and booking diverse activities, you ensure that what’s spent enhances your overall travel encounter both culturally and educationally.

Step 3: Don’t forget hidden or overlooked costs

Progressing past core expenses, considering hidden costs becomes crucial for an accurate travel budget. Acknowledging elements like travel insurance, visa fees, and unexpected expenses can shelter you from financial woes, ensuring security alongside sound financial management.

Travel insurance

A negligible cost for peace of mind, travel insurance covers unforeseen incidents and enhances financial security.

- Medical Coverage: Essential for health emergencies, especially when medical costs can skyrocket abroad.

- Cancellation Protection: Should emergency situations disrupt your plans, such protection mitigates refund risks.

- Baggage & Theft: That extra layer ensures your valuables are protected, indispensable in case of loss or theft.

Analyzing insurance policies can offer more extensive security, allowing minor investments to save substantial expenses.

Visa fees and taxes

Account for immigration costs early to prevent financial setbacks.

- Visa Fees: Depending on destination, fees may range from $20 upwards, depending on processing speed and type.

- Local Taxes: Anticipate additional costs like departure fees or tourism taxes that augment daily spendings.

Meticulously planning for these can help smooth your journey, ensuring all necessary documents are acquired without hitches.

Local sim cards, data, and connectivity

Staying connected abroad need not become a financial burden with informed choices on communication.

- Purchase a Local SIM: Often cheaper than roaming plans, they help manage costs while traveling.

- Data Plans: Choose the right size package for your needs, avoiding overage charges presented by mobile carriers.

- Wi-Fi Accessibility: Leverage publicly accessible Wi-Fi to economize on data use.

Through strategic connectivity decisions, communication sustains your travels without becoming exorbitant, preserving adequate budget allocation elsewhere.

Tips, donations, and emergency funds

Ensuring your budget includes discretionary spending avoids awkward situations and streamlines financial planning.

- Tipping & Community Donations: Acknowledge cultural norms and show appreciation where relevant.

- Contingency Funds: Vital for unplanned expenses, ensuring readiness for urgent scenarios.

- Spontaneous Activities: Extra funds may unlock unexpected opportunities securing adaptability.

Wise preparation for unpredictable expenses grants adaptability and secures enjoyment, keeping surprises pleasant rather than strenuous.

Explore the latest posts in our AI Travel Guide to craft the best travel plans tailored for you.

Step 4: Use tools and AI to help you budget

Incorporating digital tools into your budgeting strategy ensures real-time financial insights and streamlined management of expenses. Leveraging technologies like Google Sheets and AI platforms aligns your budgetary analysis with precision, fostering accuracy and efficiency.

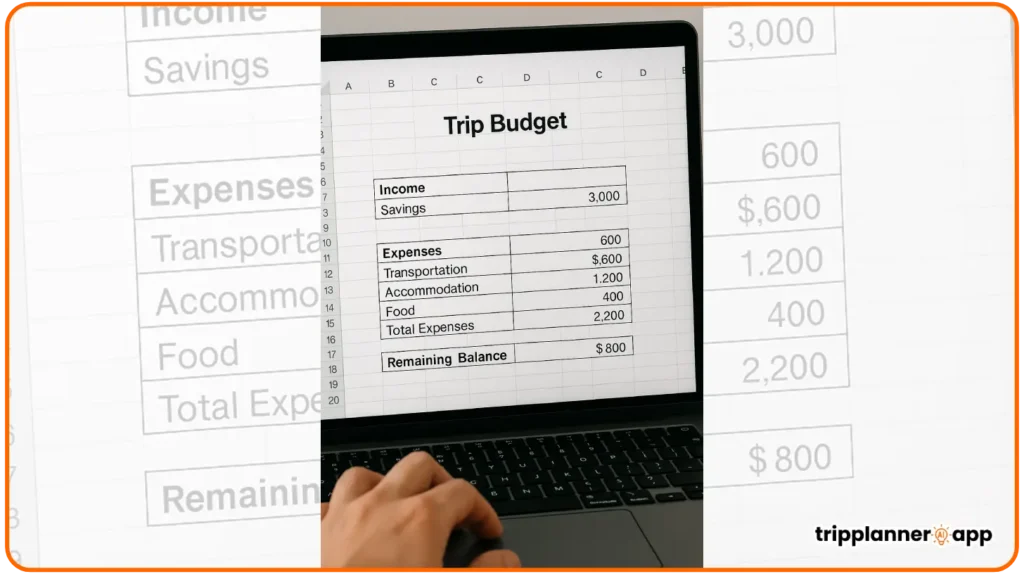

Google Sheets + ChatGPT for real-time estimations

Using Google Sheets alongside AI, such as ChatGPT, facilitates a dynamic environment for budgeting with technology.

- Real-Time Tracking: Easily input and access data that informs your financial status constantly.

- ChatGPT Insights: Ask the AI to predict spending against present tendencies, using these forecasts to gauge potential over-expenditure.

- Expense Breakdown: Utilize ChatGPT and Sheets to visualize data categorizing and adjusting financial plans seamlessly.

Harnessing these tools not only supports active budgeting but equips you with the foresight necessary to ensure financial adherence throughout the journey.

Use apps: Trail Wallet, TravelSpend, Splitwise

Embrace travel-specific applications designed for financial oversight:

- Trail Wallet: This app categorizes expenses for easy tracking, promotes financial restraint, and provides comprehensive budget reports.

- TravelSpend: Excellent for multi-currency tracking and international treks; organize expenses through an intuitive interface.

- Splitwise: For group travel, this app divides costs equitably, preventing delayed reimbursements by providing real-time transparency.

By incorporating these assets into your travel routine, you bolster financial discipline while mitigating stress through structured expenditure management.

Google Flights and Rome2Rio for transport comparison

Digital platforms that streamline travel searches ensure affordable and convenient itineraries from the very beginning.

- Google Flights: Offers price alerts, fare comparisons, and detailed breakdowns, maximizing flight affordability.

- Rome2Rio: Combines multimodal travel options allowing diverse transport strategies.

- Route Planning: These tools enhance logistical understanding, ensuring seamless travel from departure to arrival.

A dual approach amalgamates convenience with economy, supporting well-paced travel goals while keeping finances intact.

Use AI itinerary planners to estimate overall spending by day

Empower your travel budgeting through AI-enhanced itinerary planners that synthesize expenses efficiently.

- Daily Estimates: These tools help visualize daily financial needs, aligning trips with fiscal goals through unprecedented clarity.

- Activity Supervision: AI-derived assessments predict costs based on current patterns, integrating travel dynamics predictively.

- Adaptive Planning: They morph as spending habits shift, providing advice on sustainable expenditure methods.

Through advanced automation, you integrate a balance between fulfilling desires and maintaining financial responsibility throughout your journey.

Step 5: Set a daily spending limit

Building off AI utilization, a critical step in regulated spending is setting daily financial confines. Anchoring your budget around manageable daily limits provides materializing control over spending while fostering fiscal restraint.

Break your budget down by day

Distributing your overall budget into daily chunks aligns with optimal financial oversight, maintaining fluidity in expenditure.

- Total Trip Analysis: Start with calculating the trip’s sum for accurate daily cut-outs.

- Daily Division: Convert these totals into allowances based on planned duration; prioritize flexibility for unpredictabilities.

- Spending Framework: Visualize each dollar’s destination, allocating for fundamental categories like dining, activities, accommodation, and transportation.

Proactive oversight supports composed spending while continuously adapting to circumstances, converting aspiration into daily financial resilience.

Use envelopes or digital wallets to stick to the plan

Implementing tactical spending management through digital measures or traditional systems ensures alignment with budgetary boundaries.

- Physical Envelopes: Precisely earmark cash for distinct categories, enabling tangible insight over planned transactions.

- Digital Wallets: Experience modernized budgeting efficiency with app-based tracking, dividing funds and monitoring flows.

- Control Mechanisms: Awareness systems visually dissect finances per envelope, embedding comprehensive spending discipline.

Instant tracking fosters accountability, underpinning financial propriety, ensuring a strategic approach yields steadfast budget adherence.

Buffer for unexpected costs (10–20%)

Always preserve a financial buffer by allocating 10-20% above standard expenditures as a contingency fund imperative for smoother spend management.

- Risk Mitigation: Safeguard against financial pitfalls with supplementary funds.

- Funding Flexibility: This presence provides diverse activation potential, safeguarding against sudden incidents.

- Practice Modesty: Decisively operate within this structure, maintaining control that promotes balance beyond spends.

Ensuring resources cushion rapid contingencies fortifies your budget’s structure, integrating preparedness into its forecast.

Step 6: Track and adjust while you travel

Implement your daily limits, guided by real-world expenditures and analytics. Real-time adaptations redefine optimistic constructs into pragmatic accomplishments.

Daily logging with mobile apps or notes

Secure fiscal organization on-the-go through detailed expense tracking utilizing mobile solutions or manually recorded insights.

- Mobile App Integration: Log expenses seamlessly into Trail Wallet or TravelSpend for transformative insights.

- Manual Entries: For more tactile approaches, rely on traditional note-taking; nurturing tracking habits.

- Directed Retrospection: Mobile systems utilize dynamic insights to adjust, enhancing on-site travel effectiveness.

Daily transparency bolsters informed decisions harmonized between superficial aspirations and financial ambitions.

Adjust on the fly: save one day to splurge another

In the spontaneity of travel, discerning spending decisions made daily empowers adaptability and amplifies quality experiences.

- Variable Adjustments: Alter current expenditures with low-effort solutions, concentrating on creating savings to enjoy splurges elsewhere.

- Strategize Balance: The refined assessments are made, maximizing value without depreciating quality.

- Practice Resilience through Adaptability: Parallel spontaneous autonomy with clear insight, spotlighting treasured experiences.

Leverage flexibility, creating a check-and-balance, coping with unpredictable circumstances while living elegantly.

AI tip: use Chatgpt to help adjust your plan live

Elevate adaptations with ChatGPT, supporting clarity during those pivotal, spontaneous decisions.

- Live Insights: At pivotal moments, explore insights tailored to your preferences, adjusting trips fluidly.

- Valuable Alternatives: In situations where plans shift, aid is offered from scrutinized proposals.

- Informed Spontaneity: ChatGPT supports seamless continuity by adapting to events, safeguarding budget offsets.

AI-enhanced, dynamic planning catalyzes swift transactions, ensuring insight remains intact while delving into endurance-building trips.

Bonus: Tips to save without sacrificing experience

Uncover travel strategies that conserve funds, capitalizing on savings without compromising the quality of your travel narrative.

- Affordable Lodging: Locate hostels or utilize apartment rentals for the optimal mix of economy and authenticity.

- Off-Peak Travel: Schedule trips flexibly, securing discounted rates while escaping from mainstream tourist flows.

- Culinary Planning: Engage in local dining traditions, assuring savored cheap eats alongside cultural emulation.

- Digital Strategies: Harness proven tools such as apps and rewards programs, maximizing purchases and streamlining itineraries.

Holistically merging savings with the art of travel amplifies priceless experiences. Fusing simplicity and sophistication, your voyage retains vibrancy without financial fragmentation.

Final thoughts

Travel budgeting is a disciplined yet rewarding endeavor that elevates not only financial management but the entire travel journey. As you craft your comprehensive budget, keep flexibility central to your approach. Travel plans rarely unfold exactly as prescribed, so cultivating resilience through adaptable budgets ensures financial security without diminishing the adventure’s essence.

Employing digital aids and analytic tools helps refine your travel strategy, offering foresight into potential roadblocks while arming you with insights to pivot swiftly. The critical reflections from your financial blueprint lay a foundation embarking with confidence knowing your budget harmonizes merrily with your wanderlust.

Ultimately, a well-constructed budget leads to an empowered traveler, exploring their deepest curiosities and realizing unexpected wonders. It is less about limiting enjoyment and more about enhancing your experience through mindful spending and awareness. Embrace these strategies, wander eagerly, and let your financial plans be as majestic as the journeys they accompany.

Conclusion

Travel budgeting isn’t just about numbers — it’s the key to traveling smarter and freer. By planning ahead and adapting your budget to your style, you unlock more meaningful experiences without the weight of financial stress. A well-balanced plan, supported by the right tools and a flexible mindset, helps every journey stay clear, focused, and exciting. The effort you invest today paves the way for unforgettable adventures tomorrow — because with smart budgeting, no destination is out of reach.